What Is a Data Product Marketplace?

A data product marketplace is a practical way for teams to find and use trusted data without turning every request into a ticket. It provides your organization with a governance layer for publishing datasets as reusable products, so consumers can discover what they need, understand what it means, and access them safely.

This is important across all industries, but it is especially critical in financial services. Banks and insurers manage intricate data systems, follow rigorous controls, and operate under high speed expectations. Teams require self-serve analytics and AI preparedness, while risk and compliance functions demand clear evidence, traceability, and uniform definitions.

This guide starts by examining the origins of marketplaces, their connection to data products and data mesh, and what a marketplace entails in practice. It then explores why financial institutions adopt marketplaces, the problems they solve, and how to design them to enable data teams to expand access while maintaining governance.

Key takeaways

-

A data product marketplace turns datasets into reusable products with ownership, shared definitions, trust signals, and controlled access.

-

In banks and and other financial institutions, the biggest wins come from reducing definition drift and replacing manual extracts with governed self-serve sharing.

-

Adoption depends on visible trust signals, such as freshness, quality, lineage, and certification tiers, that align with how teams actually use data.

-

The marketplace needs an operating model. Clear roles, lifecycle gates, and access workflows keep products reliable and audit-ready.

Data marketplaces in context

Most organizations found themselves in a quickly growing data sprawl. The initial steps of giving a small number of experts direct access to databases later gave way to warehouses and lakehouses, curated marts, and dashboards. However, more data assets meant more confusion, more duplication, and more time spent figuring out which table to trust.

Data catalogs were created to record assets and enhance discoverability. While they organized information, they often only provided an inventory overview. Users could locate data, but faced challenges in using it reliably and accessing it securely. This issue became more apparent as self-serve platforms were adopted by more teams.

The marketplace idea addresses that gap. It treats internal data like an offering that must be understandable, reliable, and governable. It packages assets with ownership, definitions, trust signals, and controlled access. The goal is to publish fewer, higher-confidence data products that many teams can reuse. In highly regulated industries, this approach reduces informal sharing and makes governance easier to apply at scale.

Related concepts

A marketplace rarely stands alone. It connects several concepts that often get discussed separately.

-

Data products are the unit of reuse. They are curated, documented, and owned offerings built for repeatable consumption.

-

Data mesh is an organizational approach, first proposed by technologist Zhamak Dehghani. It pushes ownership closer to domains like risk, finance, claims, and customer operations while maintaining shared standards across the enterprise.

-

A semantic layer and business glossary help teams agree on meaning. They reduce metric chaos by making definitions explicit and consistent across tools.

-

A data catalog helps teams locate assets and understand technical metadata, lineage, and stewardship. It improves discoverability and provides data users with an inventory of data assets.

-

A data product marketplace pulls these threads together into a system for discovery and controlled consumption. It gives teams a place to publish approved products, attach shared definitions, surface trust signals, and enforce access policies. It can work with a mesh approach or a centralized team, but it always needs product discipline. Without that discipline, the marketplace becomes another directory that teams browse once and ignore.

Data product marketplace: What is it for?

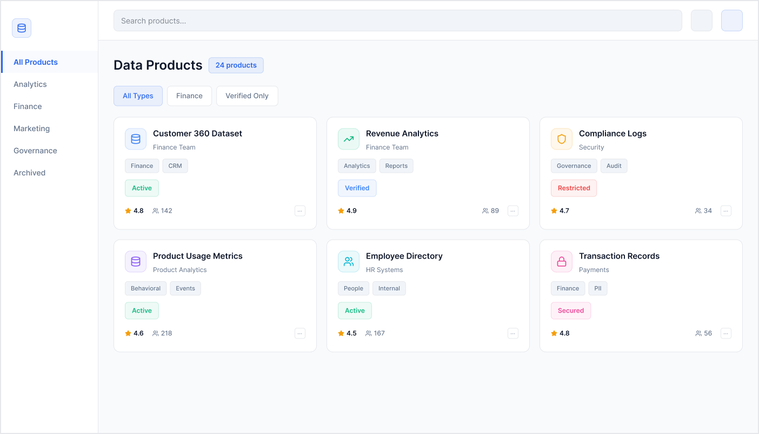

A data product marketplace is a platform that simplifies the discovery, sharing, and internal distribution of data products. It offers a governed way to turn your organization’s datasets into searchable, reusable products that teams can discover, trust, and access safely.

Data marketplaces are a great fit for banks and insurers, as these organizations have more data than they can ever hope to use. However, this data is hard to find, hard to use consistently, and hard to share securely across domains, regions, and legal entities in an environment where regulations are becoming more strict. Without a reliable way to facilitate data discovery and sharing, these organizations get bogged down in duplicated pipelines, conflicting definitions, slow delivery, and a steady stream of one-off extracts that increase operational risk.

A data product marketplace addresses this by packaging data as products with what consumers need to use them responsibly: Clear ownership, shared definitions, documentation, signals to gauge quality, lineage context, and granular access controls with auditable approvals. With a data marketplace, users get to leverage approved, certified products to answer specific questions, instead of searching for individual tables or reports.

Why now and what changed

The pressure on Heads of Data is coming from both directions.

On one side, the business expects faster delivery. Teams want self-serve analytics, real-time performance monitoring, and AI-ready data foundations. On the other side, regulatory and operational expectations are rising while data estates are becoming more complex with multiple clouds, multiple warehouses, more third-party sources, and more consumers across the organization.

This combination creates a familiar trap where either you move fast by copying data and loosening controls, or you stay safe by centralizing everything and slowing down delivery. Neither scales.

A data product marketplace offers a third option: Standardize what gets shared, attach governance to the product, and let teams discover and consume data through a controlled system that still feels self-serve. It’s a way to scale access while preserving consistency, privacy, and auditability when hundreds of teams are requesting data in parallel.

The problem a data marketplace solves in banks and insurers

Most financial institutions do not have a data shortage problem. They have a coordination problem.

Data is spread across core systems, warehouses, lakehouses, risk platforms, claims systems, CRM, finance tools, and vendor feeds. Each domain has its own priorities, terminology, and delivery cadence.

Over time, teams build local fixes. Spreadsheets, manual exports, shadow marts, and temporary pipelines become permanent. The business gets answers, but the organization pays repeatedly through duplicated work, inconsistent reporting, and increasing operational risk. The most visible symptom is definition drift. Terms like “customer,” “active account”, “written premium,” or “loss ratio” can mean different things depending on the team, the source system, and the filters applied. Even when teams agree on the word, they may not agree on the logic. This creates friction between finance, risk, compliance, and analytics.

The second symptom is access gridlock. Sensitive fields require protection, approvals, and evidence. When the safe path is slow, teams create unsafe paths. They export files, email extracts, widen permissions, or copy restricted datasets to places they should not be. A data product marketplace is designed to solve these two problems together: it makes data easier to use and easier to govern without forcing every request through a ticket queue.

Data product marketplace vs data catalog

A data catalog is a registry of data assets such as tables, dashboards, reports, pipelines, and their metadata. It is essential, but it often stops at listing what exists. It helps you find assets and understand their origins, but it does not always make data consumption safe and repeatable.

A data product marketplace goes a step further. It is designed to facilitate consumption and controlled sharing. In a marketplace, what gets published is not just an asset, but a data product with clear ownership, shared definitions, quality expectations, and an access model that can be approved, provisioned, and audited.

In practical terms:

-

Data catalog: “Here is the customer table and where it comes from.”

-

Data marketplace: “Here is the Certified Customer Profile product, here are the definitions it uses, here is its SLA and quality status, and here is how to request access with audit logging.”

Most financial institutions need both. The catalog organizes and documents the landscape. The marketplace operationalizes trust, standardization, and secure access at scale. If your catalog is underused, the missing piece is often productization and governance that supports real consumption.

What makes data a product

Data becomes a product when it is packaged for reuse, not just exposed for access. A data product is a managed offering with a clear purpose and the supporting context consumers need to use it correctly, as opposed to a dataset, which is usually a raw or curated asset that exists in a warehouse or lakehouse.

A data product has a named owner, a defined scope, and the context consumers need to use it correctly. That includes documentation, quality expectations, freshness targets, and clear rules about what can change and how consumers will be notified. Most importantly, it includes an access model that supports safe self-serve rather than informal sharing.

In a marketplace, the goal is to publish fewer, higher-confidence products that many teams can rely on. This reduces duplicated pipelines and stops every new project from starting with a fresh round of data interpretation.

Shared definitions and consistency

In financial services, inconsistency rarely looks like a broken pipeline; rather, it's two correct reports that disagree. The root cause is usually semantic. Fields and metrics carry different logic across teams, regions, and legal entities. Even small differences, such as active status logic or time window rules, can invalidate comparisons and slow decision-making.

Shared definitions solve this by making meaning explicit and reusable. A marketplace supports semantic alignment by tying business terms, metric logic, and data fields together in one place. It provides consumers with a consistent language across domains such as risk, finance, claims, underwriting, and customer operations. It also reduces the need for each team to rebuild definitions inside dashboards or spreadsheets.

Consistency is not about enforcing one definition for everything. It is about making definitions discoverable, approved, and comparable. When variations are necessary, they should be intentional and clearly labeled so teams can choose the right one with confidence.

This is a core reason marketplaces outperform ad-hoc documentation and tribal knowledge.

Trust signals for freshness, quality, lineage, and certification

Discovery alone does not create adoption. Trust does. In regulated environments, trust must be earned with signals that are visible, current, and easy to interpret.

A strong marketplace surfaces operational trust signals directly on the product. Freshness tells consumers whether the data is up to date and whether delays are known. Quality signals include checks for completeness, validity, duplication, and reconciliation with source systems. Lineage explains where the data came from and which transformations shaped it, which helps teams assess suitability and troubleshoot issues faster.

A data marketplace manages governance through certification tiers. In this framework, an initial draft product allows for exploration. Once approved, a data product can be shared with specific controls. Only a certified product can be used for high-stakes reporting with stronger requirements and ownership commitments.

These signals reduce back-and-forth between producers and consumers and limit accidental use of unreliable assets.

Secure sharing with granular access controls, approvals, and auditability

Financial institutions need self-serve access that still behaves like a controlled system. A marketplace enables this by combining granular access policies with workflows and logging that satisfy governance requirements.

Granular controls can restrict access by role, business unit, legal entity, region, and sensitivity level. They can also limit which columns are visible and which rows a user can see. This matters when a single product serves many teams, each with different entitlements.

Auditability completes the picture. The marketplace should record who requested access, who approved it, what was granted, and when it was used. This makes reviews and recertification practical and helps reduce over-permissioning over time.

When secure sharing is built into the marketplace, teams stop relying on manual extracts and overly broad access grants. They get speed without losing accountability.

Quick self-assessment to see if you need one

You are a strong candidate for a data product marketplace if most of these are true.

-

Teams spend significant time searching for data or validating it after they find it

-

Different departments report different numbers for the same KPI and reconciliation is frequent

-

Access requests are slow, manual, or frequently bypassed through exports

-

Sensitive data is shared through manual exports or copied into uncontrolled environments.

-

The same datasets are rebuilt repeatedly for similar use cases across business units.

-

You lack a clear ownership model for shared data assets

-

Auditors ask for evidence of who accessed sensitive data and why

-

You want self-serve analytics and AI readiness without relaxing governance

If you recognized your organization in several bullets, a marketplace can turn ad hoc sharing into a governed system that still supports speed. The biggest indicator is not how much data you have but how often teams rebuild the same logic, argue about definitions, or move data through informal channels to get work done.

Conclusion

A data product marketplace helps financial institutions scale data usage without sacrificing governance. It brings structure to what gets shared and how it is consumed, so teams can move faster with fewer inconsistencies and fewer risky workarounds.

The best approach to implement a data product marketplace is to start small with a handful of high-impact products, make trust and access controls obvious, and measure reuse. With the right operating model behind it, the marketplace becomes a durable foundation for analytics, reporting, and AI initiatives across the organization.

Peaka’s data marketplace is built to turn datasets into searchable data products, allowing teams use and securely share governed data with clear definitions and granular access controls.

Book a demo to see how Peaka powers a data product marketplace for enterprises.

Please

fill out this field

Please

fill out this field